HOW I BECAME A BUDGETING QUEEN

In my early 20's I was fortunate enough to be a full charge bookkeeper for a small company. And my boss was a tyrant. I had to know the bank balance at any given moment. If the reconcile was one penny off, I would silently sweat in a panic as he paced behind me not letting him in on the error until I found it, only then brushing it off as a simple oversight.

It was the best job I ever had.

Crazy? Nope. I became a very nimble money minder. To this day, I keep track of every receipt, every expense, I seek out ways to improve my systems, I read about home budgets, 'budgeting your money', and read tips on budgeting from any source I find.

Over the years, I began to notice that all the articles I had read were repeating themselves. I knew these techniques and had been using them. I wanted something new, and yet all I could find were the same ideas reassembled in a new article.

It was then that I realized I had come full circle. I had learned and applied these techniques, but still our home budget was always in the negative. Why were we living paycheck to paycheck? There was something missing from my home budgeting puzzle.

A CHINK IN MY BUDGETING ARMOR

A CHINK IN MY BUDGETING ARMOR

I have to tell you first that I also married a spender. One day he came home with a brand new truck. Oh yes, you read that right. A new TRUCK. No previous discussion, just "Hi Honey! I'm home! Come check this out!"

Now, I'm the saver and I would happily stay at home and admire our savings account balance rather than go on a vacation. My husband LOVES to eat out, go on road trips, stay in hotels. ARGHHHHH!!! This is agony for my saver personality, but we found middle ground in order to gain the biggest savings of all... our marriage.

The middle ground was that I would relax a little and he would tighten up a little. Fewer road trips, cheaper and less frequent restaurants, and from here on out, only used cars.

I have to tell you first that I also married a spender. One day he came home with a brand new truck. Oh yes, you read that right. A new TRUCK. No previous discussion, just "Hi Honey! I'm home! Come check this out!"

Now, I'm the saver and I would happily stay at home and admire our savings account balance rather than go on a vacation. My husband LOVES to eat out, go on road trips, stay in hotels. ARGHHHHH!!! This is agony for my saver personality, but we found middle ground in order to gain the biggest savings of all... our marriage.

The middle ground was that I would relax a little and he would tighten up a little. Fewer road trips, cheaper and less frequent restaurants, and from here on out, only used cars.

Labels:

2) A Chink In My Budgeting Armor

THE MISSING PUZZLE PIECE FOUND

THE MISSING PUZZLE PIECE FOUND

Then one day I had an epiphany. I had been tracking our expenses until I was blue in the face, I was averaging our monthly expenditures, I had a spreadsheet all pretty and efficient. And still we were overspending and getting further in debt. For instance, we averaged about $700 a month on groceries. If the checkbook was empty, I'd put the groceries on a credit card, justifying that the next paycheck would cover it. And we went went further and further into financial hell.

Now here is the missing puzzle piece, so read this carefully, it will turn your financial life around in a serious way.

The missing piece was the realization that all my tracking and averaging was NOT budgeting. I knew exactly what we spent every single month. The missing key was knowing how much we SHOULD be spending every single month.

Just because we averaged $700 on groceries does not mean that we could afford $700. So the next step was to find the magic formula on how much we should be spending.

I'm going to send you to a website and I want you to know, from one saver to another potential saver, these links and tools are free, and including my Free Budget Tracker Spreadsheet . (When it opens, click File, Download As, and choose the format you prefer.)

You also need the Spending Plan Online Calculator. It is a free tool from Crown Financial Ministries which is a religious site and if that offends you, then you need to just get over it. Use the calculator and move on.

(Picture below - not a live link - click to zoom in)

Then one day I had an epiphany. I had been tracking our expenses until I was blue in the face, I was averaging our monthly expenditures, I had a spreadsheet all pretty and efficient. And still we were overspending and getting further in debt. For instance, we averaged about $700 a month on groceries. If the checkbook was empty, I'd put the groceries on a credit card, justifying that the next paycheck would cover it. And we went went further and further into financial hell.

Now here is the missing puzzle piece, so read this carefully, it will turn your financial life around in a serious way.

The missing piece was the realization that all my tracking and averaging was NOT budgeting. I knew exactly what we spent every single month. The missing key was knowing how much we SHOULD be spending every single month.

Just because we averaged $700 on groceries does not mean that we could afford $700. So the next step was to find the magic formula on how much we should be spending.

I'm going to send you to a website and I want you to know, from one saver to another potential saver, these links and tools are free, and including my Free Budget Tracker Spreadsheet . (When it opens, click File, Download As, and choose the format you prefer.)

You also need the Spending Plan Online Calculator. It is a free tool from Crown Financial Ministries which is a religious site and if that offends you, then you need to just get over it. Use the calculator and move on.

(Picture below - not a live link - click to zoom in)

HOW WE SAVED $171.98 PER MONTH

HOW WE SAVED $171.98 PER MONTH

We also agreed to discuss our spending plans at the beginning of every month. Since I had been taking care of the bills he really never saw the depth of our hole. I would tell him, show him spreadsheets, get angry at his apparent disregard for my stress over finances, but we never really had finance meetings. (I was a real party ...sarcasm.)

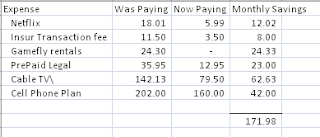

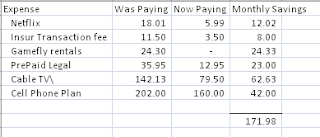

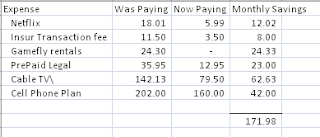

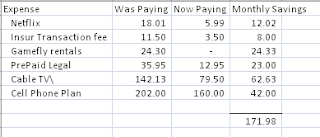

When we came together with open minds and all hard feelings aside (from me), we were able to discuss the necessity of all the repetitive services we paid each month. Here is the cut list and the final tally:

Total savings of $171.98 per month, OR $2,063.76 PER YEAR!!! Woo Hoo!! This is one happy saver! And that's just the beginning. There's more...

We also agreed to discuss our spending plans at the beginning of every month. Since I had been taking care of the bills he really never saw the depth of our hole. I would tell him, show him spreadsheets, get angry at his apparent disregard for my stress over finances, but we never really had finance meetings. (I was a real party ...sarcasm.)

When we came together with open minds and all hard feelings aside (from me), we were able to discuss the necessity of all the repetitive services we paid each month. Here is the cut list and the final tally:

Total savings of $171.98 per month, OR $2,063.76 PER YEAR!!! Woo Hoo!! This is one happy saver! And that's just the beginning. There's more...

GET OFF CREDIT; GET ON CASH

GET OFF CREDIT; GET ON CASH

What happens when you go to the grocery store and you are hungry? You grab a cart and everything you see looks DELICIOUS! The credit card is your savior!

Guess what happens when you go to the grocery store hungry and you have a $20 bill in your pocket because you purposely left all your credit cards and checkbook in the desk drawer at home. Here's what happens... you shop carefully and quickly, and stick to the list. When we only brought cash we saved $300 a month on groceries!

$300 per month for a year is a savings of $3600, combined with our monthly trimmings up above, that is a grand total of $5663.76 savings per year.

And guess what we did with all that extra money! We paid off the evil credit cards, cut them to pieces and closed the accounts. Never again will we go back to the lie of credit cards.

What happens when you go to the grocery store and you are hungry? You grab a cart and everything you see looks DELICIOUS! The credit card is your savior!

Guess what happens when you go to the grocery store hungry and you have a $20 bill in your pocket because you purposely left all your credit cards and checkbook in the desk drawer at home. Here's what happens... you shop carefully and quickly, and stick to the list. When we only brought cash we saved $300 a month on groceries!

$300 per month for a year is a savings of $3600, combined with our monthly trimmings up above, that is a grand total of $5663.76 savings per year.

And guess what we did with all that extra money! We paid off the evil credit cards, cut them to pieces and closed the accounts. Never again will we go back to the lie of credit cards.

Labels:

5) Get Off Credit; Get On Cash

HAPPILY EVER AFTER?

HAPPILY EVER AFTER?

I'd like to think that our financial life is happier, but the reality in our current economy is that we took a $10,000 hit on our income last year, and a $20,000 hit the year before. So we are down by $30K in 2 years. That will pierce even the most defensive and worthy budgets.

The next step was to change our choices and lifestyle. Except for special occassions like birthdays and anniversary, we almost never eat out. (And - shocker - we are all healthier for it.) I price shop online so I know if I'm getting a good deal locally. I ate dirt and asked our CPA for a discount. Gulp. The hardest question ever emailed. (I didn't say I was brave.)

I put a box of granola bars in my car so if I'm famished and can't get home for lunch, I have a snack at the ready to tide me over. A great alternative to spending money on bagels at a coffee shop. We also gave up latte's long ago.

We are planning a trip 'back home' this summer and are looking forward to the drive and camping along the way. Air travel is out of the question.

My husband is a plumber, so his work clothes come from the thrift store. I was blessed with two boys, so we have never had the hair and clothing expenses. And I take care of my wardrobe, classic style pieces and a little shoe polish goes a long way.

And the best defense to an attack on your budget is the word "No". No, I don't need it. I may WANT it real bad, but I don't NEED it. You should practice saying it. The world won't fall apart if you decline an invitation to a baby shower, or decide to do your own oil changes instead of a quick lube shop.

We will all be ok through this coming decade, and we will be stronger from it. In the meantime, I wish you much success in getting your home's financial life in shape.

I'd like to think that our financial life is happier, but the reality in our current economy is that we took a $10,000 hit on our income last year, and a $20,000 hit the year before. So we are down by $30K in 2 years. That will pierce even the most defensive and worthy budgets.

The next step was to change our choices and lifestyle. Except for special occassions like birthdays and anniversary, we almost never eat out. (And - shocker - we are all healthier for it.) I price shop online so I know if I'm getting a good deal locally. I ate dirt and asked our CPA for a discount. Gulp. The hardest question ever emailed. (I didn't say I was brave.)

I put a box of granola bars in my car so if I'm famished and can't get home for lunch, I have a snack at the ready to tide me over. A great alternative to spending money on bagels at a coffee shop. We also gave up latte's long ago.

We are planning a trip 'back home' this summer and are looking forward to the drive and camping along the way. Air travel is out of the question.

My husband is a plumber, so his work clothes come from the thrift store. I was blessed with two boys, so we have never had the hair and clothing expenses. And I take care of my wardrobe, classic style pieces and a little shoe polish goes a long way.

And the best defense to an attack on your budget is the word "No". No, I don't need it. I may WANT it real bad, but I don't NEED it. You should practice saying it. The world won't fall apart if you decline an invitation to a baby shower, or decide to do your own oil changes instead of a quick lube shop.

We will all be ok through this coming decade, and we will be stronger from it. In the meantime, I wish you much success in getting your home's financial life in shape.

Labels:

6) Happily Ever After?

How to Budget... Summary

1. Talk to your better half, AGREE to control spending. PUT IT ON PAPER AND TAPE IT TO THE WALL! Shake hands. (It's a powerful gesture.)

2. Track all expenses with the Free Budget Tracker Spreadsheet . (When it opens, click File, Download As, and choose the format you prefer.)

3. Go to the budget calculator tool and get a reality check on your spending: Spending Plan Online Calculator.

4. Decide what you WANT and what you NEED. Cut out the wants, and trim down the needs. See my cut list below:

5. Shred the credit cards even before you pay them off. They are an evil crutch. Pay them off, CLOSE THE ACCOUNTS.

6. Allow one extra expense - Dave Ramsey's book featured to the right of this post. It will save your financial life.

2. Track all expenses with the Free Budget Tracker Spreadsheet . (When it opens, click File, Download As, and choose the format you prefer.)

3. Go to the budget calculator tool and get a reality check on your spending: Spending Plan Online Calculator.

4. Decide what you WANT and what you NEED. Cut out the wants, and trim down the needs. See my cut list below:

5. Shred the credit cards even before you pay them off. They are an evil crutch. Pay them off, CLOSE THE ACCOUNTS.

6. Allow one extra expense - Dave Ramsey's book featured to the right of this post. It will save your financial life.

Labels:

7) How to Budget... Summary

Subscribe to:

Posts (Atom)